xx

The limited number of bedrooms on self sufficient Cars has already created substantial interest in and many pending single sales include small groups that book the complete Car,

with all of the available bedrooms.

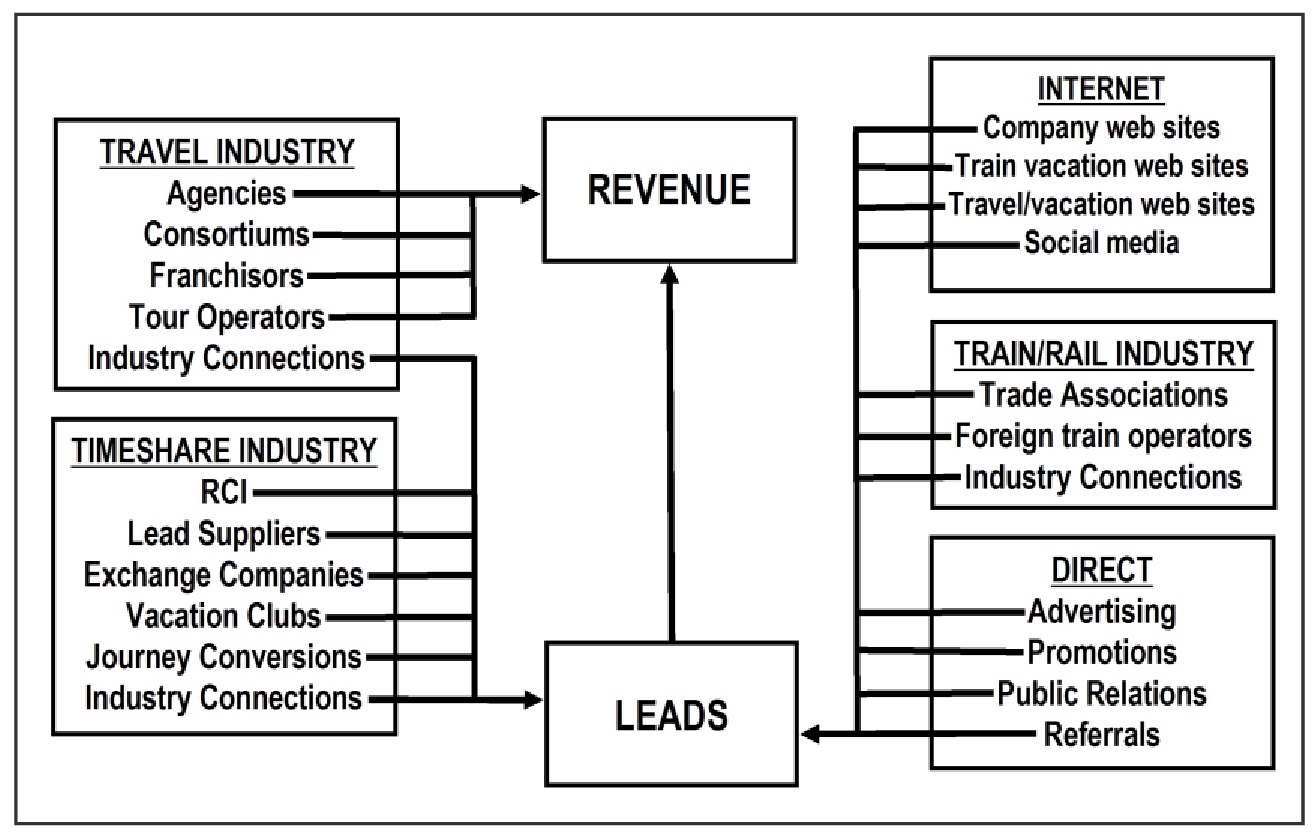

Detailed consideration of sales lead sources, related cost per leads and sales closing ratios confirm that a combination of only several lead sources described in Chart 1 can sell all Journey products.

Based on management’s prior lead to sale conversion experience and evolving sales results, lead sources that produce the highest closing ratio at the lowest cost will be emphasized.

Journey by Rail growth should mirror the worldwide accelerating demand for luxury river cruises 29. Comparably priced cruises sell to the same market and provide similar vacation objectives with layovers at en-route places. The difference between them and ATs is that one floats and the other travels on train tracks, and that river cruise demand is being met because new river ships are being built 30 but “There will be a limitation on availability of luxury train inventory for the foreseeable future” 31 because demand for luxury train vacations exceeds the number available. ATs has access to volume travel agency sellers of river cruises.

Sales will be made directly or through known agents to: existing qualified individuals; affinity and other groups; corporations; other leads already known to ATs and agencies; and, to leads: coming from editorial exposure ranging from current internet to key magazine articles 32; generated by advertising and promotion; purchased from lead generators to the extent (if any) necessary. Repeat and referral customers will grow and become a major low lead cost source of buyers; management’s prior luxury vacation experience includes more than 50% of sales coming from repeat and referral customer.

Depending on how evolving circumstances impact sales and related earning performance, the sale of either individual Journey vacations or Train’Shares can be purposely emphasized. The two products can be separated for business purposes.

11. The Company, Valuation

America’s Trains Inc. (ATs) is a Wyoming corporation. Senior management presently holds the majority of ATs stock.

To date a total of 1,236,540 common voting shares have been issued for a total investment of $618,112, which is $0.50 per share.

An additional 410,000 common shares have been allotted for management and otherwise for reasons intended to enhance ATs’ business, at a price expected to exceed $0.50 per share. These shares may be issued to managers in lieu of salaries.

Common shares have been paid for by cash, and by provision of management services valued at under 40% of their market value.

A capitalization table is available.

Based on completed comprehensive concept and business development, positive market forces, present operational capabilities, growth prospects, imminent positive cash flow and related net income, the pre funding valuation of ATs is

29 See https://americantrainvacations.com/atv/documents/referencesluxurytravel – lines 37 to 49

30 See https://www.cruisecritic.com/articles.cfm?ID=2893

31 Reference: Tim Littler, owner/operator of Golden Eagle Tours in Europe and new (2022) upscale train vacations in India and South Africa.

32 Unsolicited editorial exposure has already been published in Popular Mechanics, The Robb Report, Departures Magazine, Forbes, various other print publications and numerous Internet sites.